We are pleased to send you the September 30, 2021 Management Report of Alignvest Student Housing Real Estate Investment Trust (“ASH REIT”).

Q3 2021 included the long-anticipated resumption of in-person classes at Canadian universities, making this arguably the most important period in our short history. We are extremely pleased to see students return to campus and confirm that online classes have not disrupted the traditional in-person teaching model.

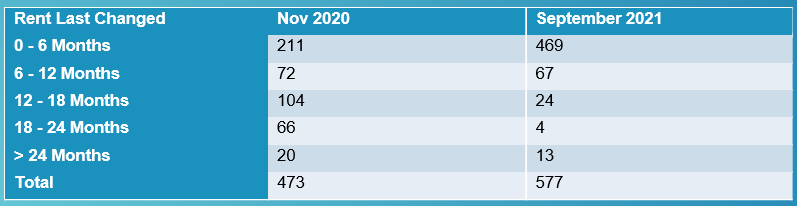

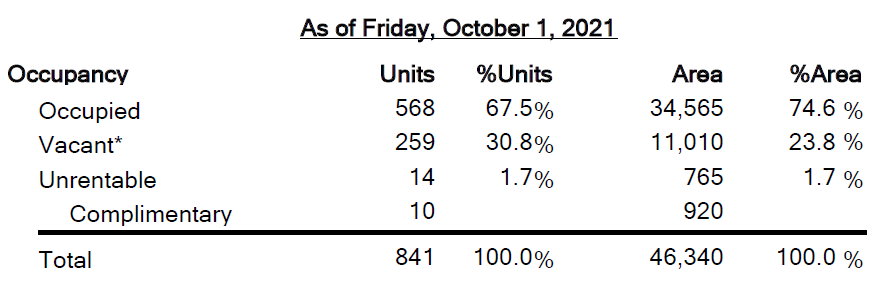

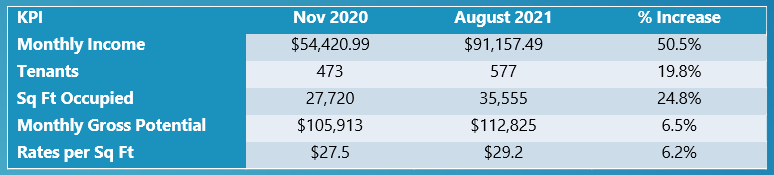

In Q3 2021, we experienced robust leasing activity. We have returned to pre-pandemic occupancy with 96% of our beds leased for the 2021/2022 school year, and we are continuing to see additional interest from students who are still making plans to return for January 2022. Importantly, we have achieved this occupancy while also growing our gross and net rent on a year-over-year basis.

We also successfully closed our previously announced acquisition of THEO, a 507-bed property with ~18,000 square feet of retail space, on July 30, 2021. Since closing, renovations were completed to increase the bed count to 528 beds. We were successful in securing attractive financing for this deal and are proud to add this high quality property to our portfolio.

Below is the link to our Management Report. Please contact us if you have any questions or need additional information.

Management Report

THEO, OTTAWA

On July 30, 2021, we closed the acquisition of THEO, a recently renovated, multi-unit student housing building located at 305 Rideau Street in Ottawa, Ontario. The 12-storey building is comprised of 193 units and 528 beds. THEO offers top of the market interior finishes including a premium modern furniture package, stainless steel appliances, quartz countertops and in suite laundry. In addition to the residential space, there is approximately 18,000 square feet of street level retail space with tenants such as Bank of Montreal, PiCo and Dollarama.