StoreWest Bluebird Development Fund Q2 Report

StoreWest Bluebird Development Fund

The Fund’s investment objective is to achieve capital appreciation through the development and sale of Class A self-storage projects across Canada.

Chestermere Self-Storage Update

We are pleased to report to our Investors with this summary of the Bluebird Storage

facilities that are currently in operation, as well as the two facilities that are

currently in the construction phase. The deal pipeline currently holds several more

facilities and development locations, including Class ‘A’ opportunities in the interior

of British Columbia, Saskatchewan, Manitoba and Ontario (Greater Toronto Area).

Please click on the below link for the full report:

Alignvest Student Housing Management Report

We are pleased to send you Alignvest Student Housing Real Estate Investment Trust’s Q4 2022 Management Report.

Our fair market value remains stable due to our strong operating performance and forecasted NOI growth in 2023. Demand for high-quality student housing continues to outpace supply, which has translated into upward pressure on rental rates and resulted in low vacancy rates (99.6% occupancy as at December 31, 2022). Our current pre-leasing velocity is providing confidence that the 2023/2024 academic year will follow similar trends; we are budgeting 2023 NOI at ~8% higher than 2022 on a same-property basis. We are pleased to report that we are already over 60% pre-leased at our privately-managed properties for September 2023 (over 20% ahead last year at the same time).

We are pleased to have delivered a 10.5% annualized net return since inception, with limited volatility. Our annualized distribution yield is 4.9% as at December 2022, equivalent to approximately a 10% pre-tax equivalent yield as it is delivered as a tax-efficient return of capital. We believe our REIT will continue to perform well in 2023 given our market leading position and our strong business fundamentals.

Below is the link to our Management Report. Please contact us if you have any questions or need additional information.

SEE-MORE, HALIFAX

We acquired 1400 Seymour Street in Halifax, Nova Scotia in January 2023 for $90 million. See-More is a 6-storey, newly constructed (2022) student housing facility located steps away from Dalhousie University. See-More has 141 fully furnished units, including bachelors, 3-bedroom, 4-bedroom and 5-bedroom suites. Additionally, See-More features several student-oriented amenities, including a yoga and wellness studio, games room, on-site laundry facilities, social rooms, common study areas and an underground parking garage.

Wright-Parkway Winter/Spring LP Update

Operational Update

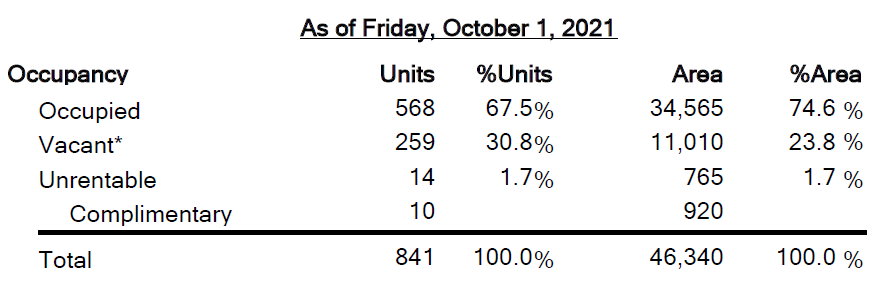

Occupancy remains strong in our two facilities in Nova Scotia. When you combine the two reports below, the percentage of units rented between the two facilities is 89.6%. If you look at the square footage, we are currently leasing out 94% of all space available. This is considered quite high for storage and Wright in particular is in need of more space with over 97% of available area currently rented!

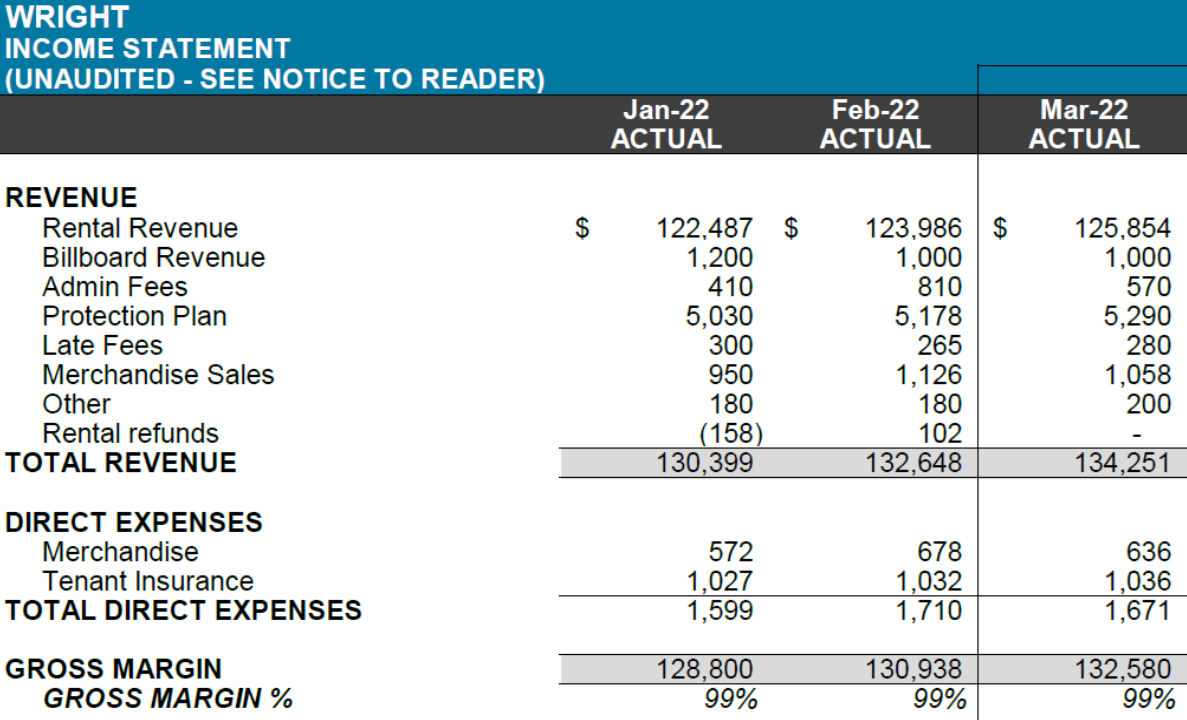

Financial Update Q1 2022

2021 was a solid year for both facilities. Our revenue for the year was $1,631,116 over 10.5 months of operation with monthly revenues increasing 10-20% over the course of the year. The Q1 numbers, as noted below, show this growth trend continuing with $500,000 of revenue in the first quarter of 2022. This puts Wright-Parkway on track to surpass $2M in revenue for 2022.

- The GP declared a second Distribution of $198,000 to LP unitholders in May, 2022

- Combined distributions paid to investors since February 2021 totals $518,904 or almost 8% on equity in just over 1 year

Management is now looking at expansion options for the Wright facility. This expansion could add 4 to 6 stories and up to 60,000 Sq Ft of much needed space to this facility. Management believes the net gain in value for Wright from such an expansion could be significant

Alignvest Student Housing – Q1 2022 Management Report

We are pleased to send you the March 31, 2022 Management Report of Alignvest Student Housing Real Estate Investment Trust (“ASH REIT”).

We are currently experiencing high inflation in Canada, with the inflation rate rising to 6.7% in March 2022. We are seeing that student housing provides very effective protection against inflation due to the natural, high turnover of student leases. While we are still in the midst of our pre-leasing season, we are executing leases at higher than budget rates and expect to achieve strong year-over-year growth in rents. Further, we continue to experience strong demand for our beds, with our pre-leasing for September 2022 currently 16% ahead of last year at this time. We expect to have another year of strong occupancy next year, consistent with our current occupancy of 98%.

In response to high inflation, the Bank of Canada increased its benchmark interest rate by 50bps on April 13, 2022 and has indicated that further rate hikes should be expected. This, combined with the uncertainty from Russia’s invasion of Ukraine, has created a volatile financing environment, with base rates and lender spreads increasing. We are pleased to have stable and attractive financing in place, with no material near-term financing requirements. With respect to potential acquisitions, we have been building up a robust cash reserve on our balance sheet to capitalize on the expected opportunities that may arise over the next few months.

Even in an inflationary and volatile financing environment, there continues to be strong interest in the student housing sector both nationally and globally. On April 19, 2022, Blackstone announced the acquisition of American Campus Communities, the largest owner/operator of student housing in the United States, for ~USD$13 billion, demonstrating the continuing confidence in the sector.

Below is the link to our Management Report.

Management ReportTravel Insurance – MFG

Stress-free travel insurance plans

Travel with peace of mind. When you choose travel insurance from Saskatchewan Blue Cross and MFG, you can rest assured that your needs will be taken care of in a medical emergency.

Contact us today for your quote 306-933-9993 or insurance@mfgltd.com

Plan Options:

Covid Details

Alignvest Student Housing – Q4 2021 Management Report

DECEMBER 31, 2021 – MANAGEMENT REPORT

We are pleased to send you the December 31, 2021 Management Report of Alignvest Student Housing Real Estate Investment Trust (“ASH REIT”).

We are proud of ASH REIT’s achievements in 2021. We finished the year with three transformative acquisitions, which increased the REIT’s asset base by 1,323 beds and over $215 million in asset value; we maintained near-full occupancy and very attractive collection rates across the portfolio through another year under COVID-19; and we have experienced positive leasing and operational results which have set the foundation for a successful 2022/23 academic year. With these achievements, we were able to deliver a net return of 12.1% in 2021, and an annualized return since inception of 11.1% (applicable to Class F unitholders, assuming DRIP participation).

While we are currently persevering through another wave of the COVID-19 pandemic, we remain optimistic that the impacts on the economy and student demographic will not hinder our operations, similar to the prior two years. We are at 98% occupancy and we expect our buildings to have near-full physical occupancy as students return to campus over the next several weeks.

Student housing continues to prove itself to be a resilient asset class and we remain excited about the outlook for the sector. Following a successful fundraising period in Q4 2021, we are now focused on acquiring additional properties in 2022 to continue to build on our track record of delivering attractive risk-adjusted returns to our investors.

Below is the link to our Management Report. Please contact us if you have any questions or need additional information.

Management ReportChestermere Self-Storage LP – Q3 2021 Update

Operational Update

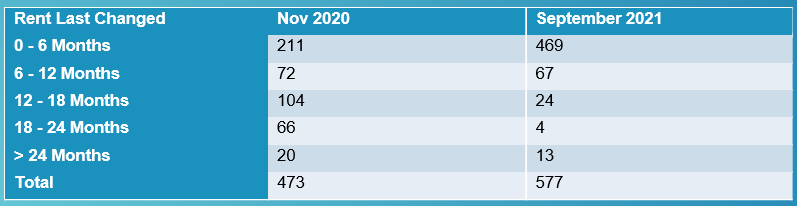

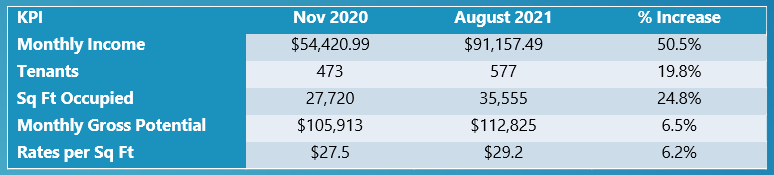

In late 2020, StoreWest replaced our existing facility Manager with Bluebird. In addition to leasing up the facility, Bluebird’s main focus has been on bringing up our revenues and financial occupancy. This has been achieved through systematic rent increases as noted below. The net result has been a dramatic increase in monthly revenue.

Financial Update

- As of the end of September, storage is at ~75% occupancy and our RV lots are at 95%+ with waiting lists.

- Chestermere is fully profitable and phase 1 is nearing full stabilization (85% occupancy)

Summer 2021 appraisal (after expansion) – Colliers $20,140,00 with roughly $7.6M in debt on property

- Management is currently focused on securing permits, financing, and a reasonable quote for the proposed phase 2 expansion.

- Phase 2 is expected to add ~28,000 SqFt net rentable and over $700,000 in gross annual revenue potential.

Essential service – no payments deferred or missed during Covid