Operational Update

Leasing up a storage facility during winter months is a bit out of the norm. We were very happy to see this trend continue while also having 11 people on the waiting list for larger units, which will help with our lease up once our expansion is complete.

Financial Update

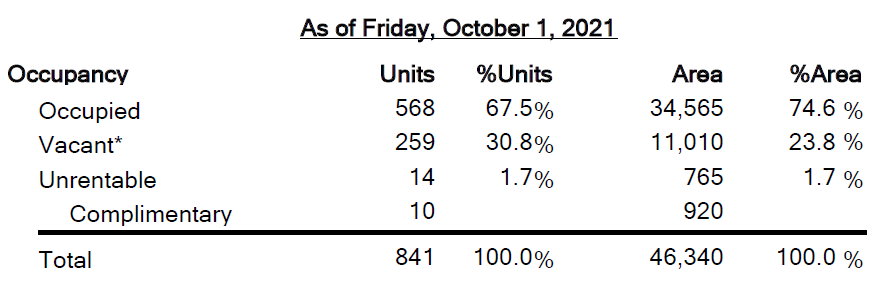

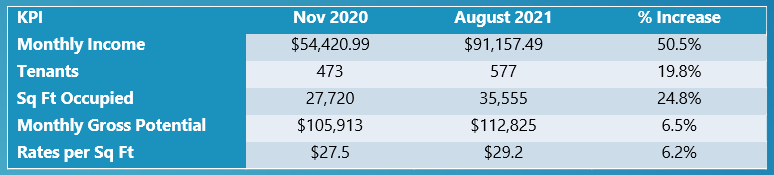

We have completed our 2021 year end and T5013s were sent to all investors at the end of March. 2021 was a great growth year for Chestermere and we ended the year at 69.9% storage occupancy with total revenues of $875,903. This represents a 47.42% increase in revenue YoY from our 2020 total of $594,161. Excluding amortization, Chestermere was profitable in 2021 – a very significant step for the LP.

As, you can see from the above YTD management reports, 2022 continues to show growth. The first quarter is typically very slow for storage, but revenue has continued to grow and occupancy as well. Chestermere is currently over 80% occupied!

“Summer 2021 appraisal (after expansion) – Colliers $20,140,00 with roughly $8M in debt on property”

- Our main goal in 2022 is to complete the planned expansion for Chestermere. Management believes the additional space will maximize revenue and position Chestermere for a potential exit in 2023

- Phase 2 is expected to add ~28,000 Sq Ft net rentable and over $700,000 in gross annual revenue potential