Car and Truck Wash Update

• Retrofit of the Automatic Truck bay is complete. New foam cannons and brushes are a big hit. Significant amount of maintenance fixes completed year-to-date.

• Memberships continue to grow with over 1300 members currently. This is up from ~700 members at start of year. We now have over 165 fleet clients as well.

• Sales in the overall car/truck wash are up 33% YoY. We have also dropped our labour by close 20% this year, while getting our chemical cost down as well.

Self-Storage Update

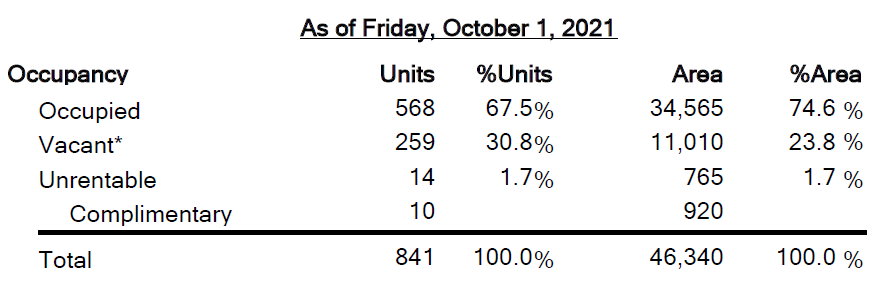

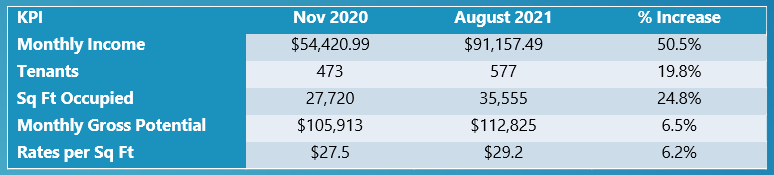

Dufferin Storage celebrated its first anniversary at the end of August. The facility achieved 35% occupancy in its first year – well ahead of projections (20% is considered normal).

At its current level of occupancy the storage facility is essentially at operational breakeven (an impressive feat in one year).

Storage is now entering the quieter period (Nov. – March), but management will continue to focus on financial occupancy while looking forward to the 2022 lease up season.

*Please note our pricing vs our competitors below

Financial Update

Management is currently working with our lender on terming out the construction loan for Dufferin Storage. As part of this process, updated appraisals were obtained on both the storage and wash from Colliers.

Colliers appraised the wash at $15.1M and storage at $28.3M (as is). This provides a total project appraisal of $43.4M with a total project cost of ~$29M (~$14.4M gain on $11M equity). While this is no guarantee of exit value it is encouraging.