Operational Update

Bluebird Storage Management continues to focus on increasing revenues and the overall economic occupancy for Henri Bourassa. The Montreal market has proven to be very strong with current occupancy levels still around 90% despite aggressive rate increases at the facility.

Financial Update

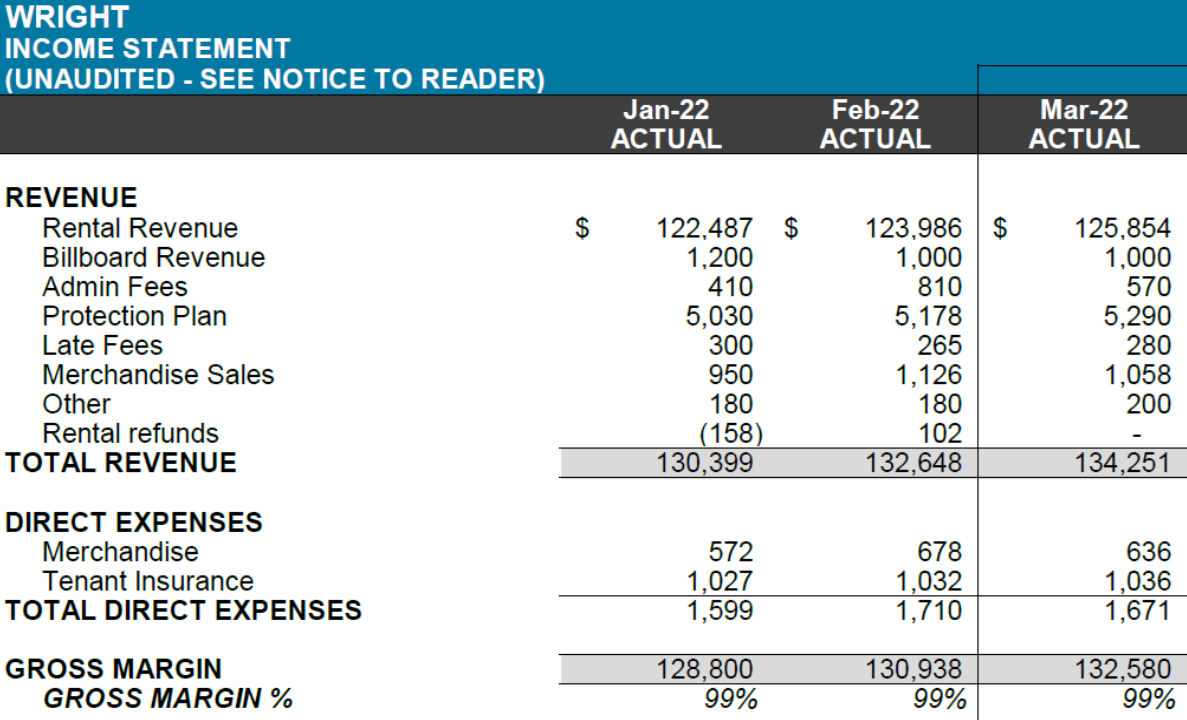

Management continued to implement rent increases throughout 2021 and focus on growing revenue. From January 2021 to December 2021 the monthly income grew from $103,037 to $127,118. This represents a 23.4% increase in monthly revenue over the course of the year.

As noted below, the growth trend has continued in 2022 with monthly rents now over $130,000 per month even though we have not hit prime rental season.

Summary

Management recently signed a commitment letter to refinance Henri Bourassa. The new lending facility is expected to reduce our overall cost of borrowing while also freeing up significant capital to enable a distribution for investors. The GP is working hard to finalize the lending so we can announce details about the potential distribution. Management is also looking at different exit opportunities for the LP over the short to medium term (storage and/or development sale).