Operational Update

Acquired by StoreWest & Bluebird in August 2020 located in Saint-Laurent, Montreal.

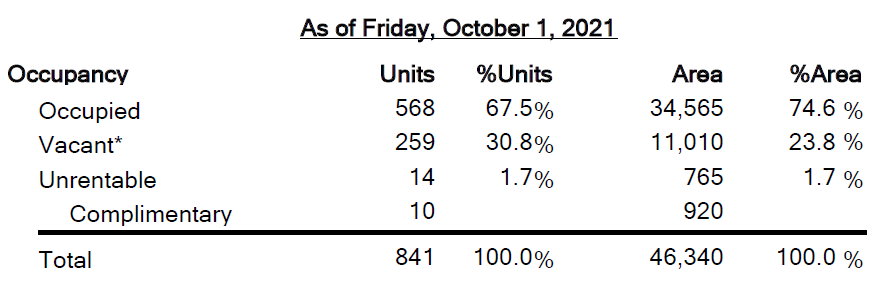

- 97,119 SF net rentable with 794 storage units

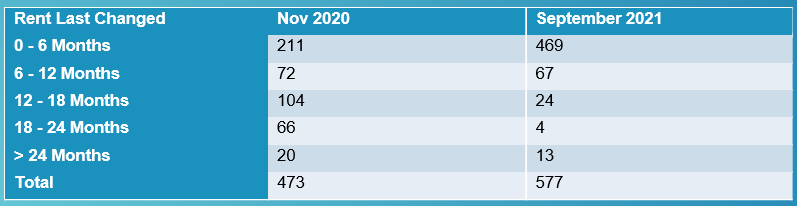

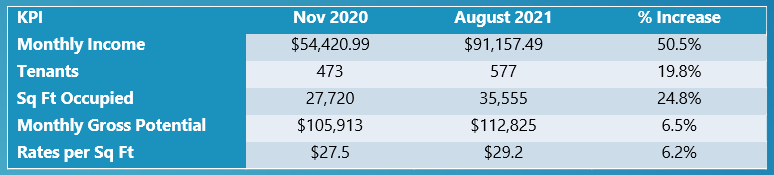

Bluebird Storage Management continues to focus on increasing revenues and the overall economic occupancy for Henri Bourassa. The Montreal market has proven to be very strong with current occupancy levels still over 90% despite aggressive rate increases at the facility.

Financial Update

Management is currently working on a refinance package with BMO on the facility which is expected to drop our overall cost of borrowing. It is expected that such a refinance should free up significant capital to enable a distribution . As part of this refinance, management is seeking an updated appraisal on the property. Additionally, we are seeking an opinion on the value of the property with residential zoning in place to determine which exit option could provide the best value for investors. We expect to announce a distribution once the financing is finalized.

Rezoning Update

Management has been working with our consultant, BC2 to advance the zoning for a multi-family development. Council has given feedback on our current plan and indicated it would be accepted. We are currently waiting until municipal elections are completed in Montreal to determine if any further densification can be negotiated. This process is likely 6-8 months out.